Compliance

Regulatory Framework

Overview of Regulations in the Carbon Credit Market

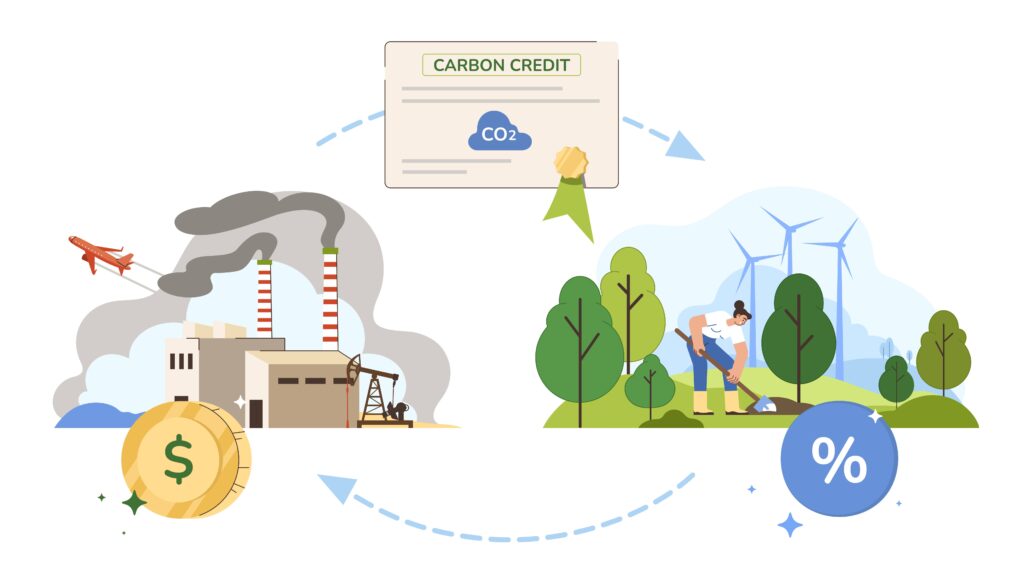

The carbon credit market operates within a complex framework of regulations designed to ensure the integrity, transparency and efficacy of carbon trading as a mechanism for reducing greenhouse gas emissions. Below is a summary of the key regulations that govern the compliance carbon credit market:

Kyoto Protocol

The Kyoto Protocol, adopted in 1997 and enforced in 2005, was the first international treaty to set legally binding emission reduction targets for developed countries. It established three market-based mechanisms:

- Clean Development Mechanism (CDM): Allows developed countries to invest in emission reduction projects in developing countries and earn Certified Emission Reduction (CER) credits.

- Joint Implementation (JI): Enables developed countries to carry out emission reduction projects in other developed countries and receive Emission Reduction Units (ERUs).

- International Emissions Trading (IET): Allows countries to trade their Assigned Amount Units (AAUs) to meet their emission targets.

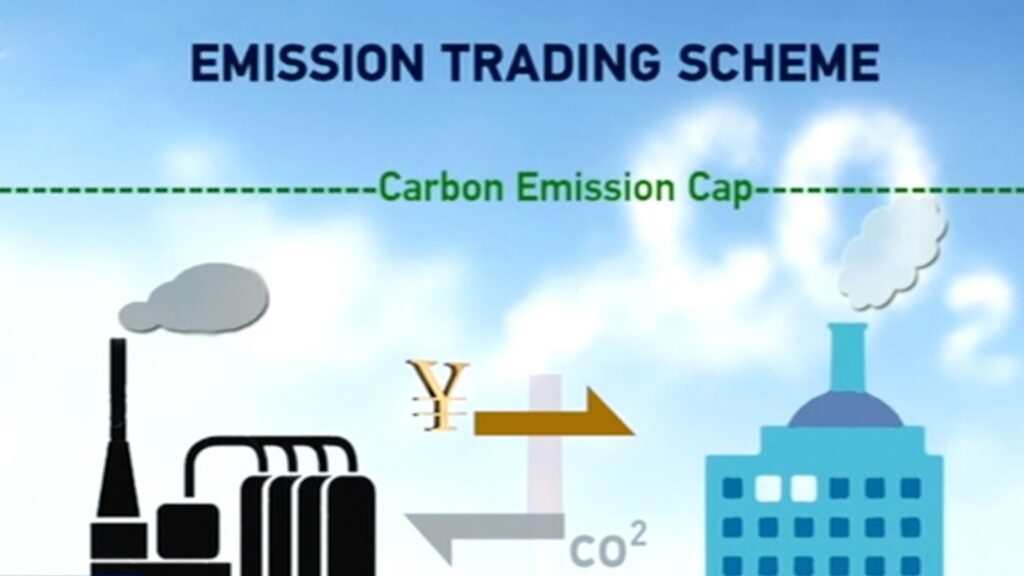

EU Emissions Trading System (EU ETS)

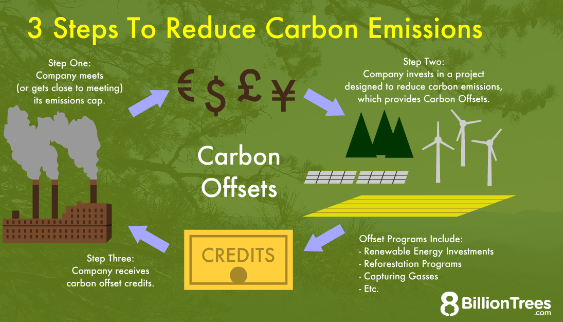

- Cap-and-Trade: A cap on the total amount of certain greenhouse gases that can be emitted by installations covered by the system, which reduces over time.

- Allowance Trading: Companies receive or buy emission allowances which they can trade with one another as needed.

- Compliance: Companies must surrender allowances equivalent to their emissions annually or face significant fines.

Paris Agreement

- Article 6: Establishes cooperative approaches for countries to achieve their NDCs, including international carbon markets.

- Article 6.2: Allows countries to transfer mitigation outcomes internationally.

- Article 6.4: Creates a centralized mechanism to promote sustainable development and emission reductions.

California Cap-and-Trade Program

- Emissions Cap: A declining cap on emissions that aims to reduce greenhouse gases to 1990 levels by 2020 and 40% below 1990 levels by 2030.

- Allowance Auctions: Regular auctions for the sale of emission allowances, with proceeds supporting California’s climate programs.

- Offsets: Provision for companies to use a certain percentage of offsets (emission reductions from projects outside the capped sectors) to meet compliance obligations.

International Civil Aviation Organization (ICAO) Carbon Offsetting and Reduction Scheme for International Aviation (CORSIA)

- Monitoring and Reporting: Airlines must monitor and report their emissions annually.

- Offsetting Requirements: Airlines must purchase eligible carbon credits to offset emissions growth.

National and Regional Carbon Pricing Mechanisms

- China’s National ETS: Launched in 2021, it covers the power sector initially, with plans to expand to other sectors.

- British Columbia Carbon Tax: A carbon tax applied to the purchase and use of fossil fuels within the province.

Voluntary Carbon Market Standards

Gold Standard: Focuses on sustainable development benefits in addition to emission reductions.

- Climate Action Reserve (CAR): Ensures environmental integrity and transparency in the voluntary market.

Compliance Requirements for Market Participants in the Carbon Credit Market

Emissions Reporting and Monitoring

- Annual Reporting: Entities must accurately monitor and report their greenhouse gas (GHG) emissions annually. This involves measuring emissions from all relevant sources within their operations.

- Verification: Reports must be verified by accredited third-party auditors to ensure accuracy and compliance with regulatory standards.

- Record Keeping: Participants are required to maintain detailed records of their emissions data, methodologies, and verification reports for a specified period, typically five years.

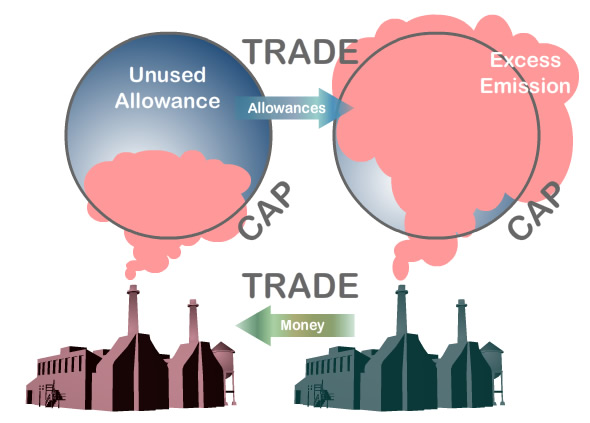

Allowance Management

- Allowance Allocation: Participants receive emission allowances based on their historical emissions, benchmarks, or through auction processes. These allowances represent the right to emit a certain amount of GHGs.

- Surrender of Allowances: At the end of each compliance period, entities must surrender enough allowances to cover their verified emissions. Failure to surrender sufficient allowances results in significant penalties.

- Banking and Borrowing: Some systems allow for banking (carrying over unused allowances to future periods) and borrowing (using future period allowances in the current period), subject to specific rules and limitations.

Compliance Deadlines

- Allowance Surrender Deadlines: Allowances must be surrendered by a specific date to avoid penalties. This deadline is often set shortly after the emissions reporting deadline to allow time for any necessary adjustments.

Third-Party Verification

Verification Standards: Verification must comply with established standards and methodologies, ensuring consistency and reliability across different entities and sectors.

Compliance Penalties

- Non-Compliance Penalties: Entities that fail to surrender sufficient allowances face substantial fines. For example, under the EU ETS, the penalty is €100 per ton of CO2 equivalent emitted without a corresponding allowance, plus the obligation to surrender the missing allowances in the following year.

- Reputational Impact: Non-compliance can also result in reputational damage, affecting an entity’s market standing and stakeholder trust.

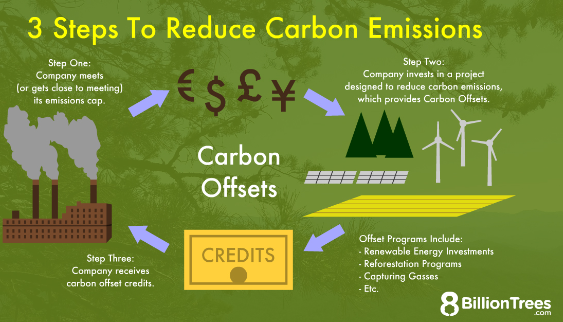

Offset Projects

- Eligibility Criteria: For those participating in systems that allow the use of carbon offsets (such as the CDM under the Kyoto Protocol or voluntary standards), projects must meet strict eligibility criteria to ensure real, measurable and additional emission reductions.

- Approval and Registration: Offset projects must be approved and registered with the relevant regulatory body, and must undergo rigorous validation and verification processes.

- Monitoring and Reporting: Similar to direct emissions, offset projects must monitor and report their emission reductions regularly, subject to third-party verification.

Compliance with Specific Market Rules

- Sector-Specific Regulations: Certain sectors may have additional compliance requirements. For example, the aviation sector under CORSIA must adhere to specific monitoring, reporting, and offsetting rules.

- National and Regional Regulations: Entities must comply with the specific rules and regulations of the carbon market in which they operate, whether it is the EU ETS, California Cap-and-Trade, China’s National ETS, or others.

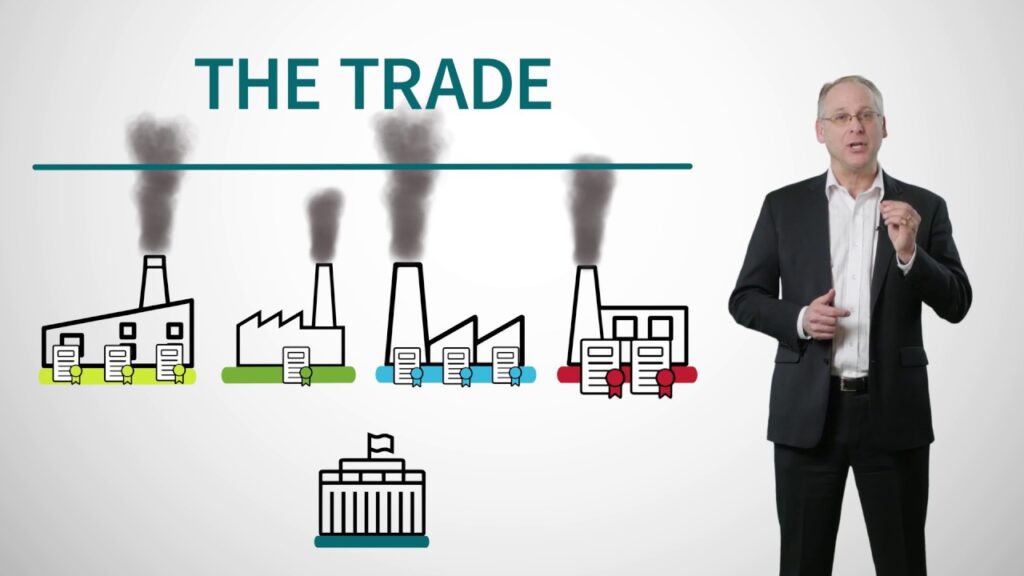

Participation in Auctions

- Auction Rules: Entities participating in allowance auctions must adhere to auction rules and procedures, including registration, bidding limits and financial settlement.

- Auction Participation: Regular participation in allowance auctions may be necessary to acquire sufficient allowances for compliance.

Transparency and Disclosure

- Public Disclosure: Many regulatory systems require the public disclosure of emissions data, allowance allocations and compliance status. This promotes transparency and accountability.

- Stakeholder Engagement: Entities are encouraged to engage with stakeholders, including investors, customers and regulators, to communicate their compliance efforts and sustainability initiatives.

Continuous Improvement

- Training and Capacity Building: Ensuring that staff are well-trained and knowledgeable about compliance obligations and carbon market dynamics is crucial for maintaining compliance.

EU-ETS/OAD Carbon Trust: Detailed Registration and Compliance

Registration Process

Initial Preparation

Legal Requirements: Understand the legal requirements specific to your country within the EU.

Application for a Greenhouse Gas Emissions Permit

-

-

- Technical description of the installation.

- Expected annual emissions.

- Description of monitoring and reporting plans.

-

Monitoring Plan

Emissions Monitoring and Reporting

Compliance Requirements

Emissions Verification

Third-Party Verification: Submit your annual emissions report to an accredited verifier for independent verification. The verifier will ensure that your report is accurate and complies with EU ETS requirements.

Verifier Approval: Obtain a verification statement from the verifier, confirming that your emissions report is compliant.

Allowance Management

Surrender Allowances: By April 30th each year, surrender a number of allowances equivalent to your verified emissions for the previous calendar year. Failure to do so will result in penalties.

Allowance Trading: You can buy, sell, or trade allowances within the EU ETS to ensure you have enough to cover your emissions.

Compliance Deadlines

Reporting Deadline: Submit your verified emissions report by March 31st each year.

Surrender Deadline: Surrender the corresponding number of allowances by April 30th each year.

Penalties for Non-Compliance

Financial Penalties: A fine of €100 per ton of CO2 equivalent emitted without a surrendered allowance.

Obligation to Cover Shortfall: You must also surrender the missing allowances in the following year.

Record Keeping

Documentation: Maintain records of emissions data, monitoring plans, verification statements, and transactions for a minimum period, usually five years.

Transparency: Be prepared for audits by national authorities to ensure ongoing compliance.

Participation in Auctions

Auction Rules: If purchasing allowances through auctions, comply with the rules set by the auction platform, including registration, bidding procedures, and payment terms.

Regular Participation: Participate in auctions as needed to secure sufficient allowances for compliance.

Use of Offset Credits

CERs and ERUs: Subject to certain limits, you can use Certified Emission Reductions (CERs) and Emission Reduction Units (ERUs) from international projects under the Kyoto Protocol to meet part of your compliance obligations.

Eligibility Criteria: Ensure that the offset credits meet the eligibility criteria set by the EU ETS.

Innovation and Modernization Funds

Accessing Funds: Leverage funds available through the EU ETS, such as the Innovation Fund and the Modernization Fund, to invest in low-carbon technologies and projects that reduce emissions.

Application Process: Follow the specific application processes and criteria for these funds to secure financial support for your emission reduction initiatives.

Stakeholder Engagement

Transparency: Engage with stakeholders, including regulators, investors, and the public, by providing transparent and accurate information about your emissions and compliance status.

Sustainability Reporting: Incorporate your EU ETS compliance and carbon management strategies into broader sustainability reporting frameworks.

Continuous Improvement

Regular Reviews: Conduct regular reviews and updates of your monitoring plan, emissions data, and compliance strategies to adapt to any changes in EU ETS regulations and improve efficiency.

Training and Capacity Building: Ensure that your team is well-trained and knowledgeable about EU ETS requirements and best practices for emissions management.

Kyoto Protocol Mechanisms

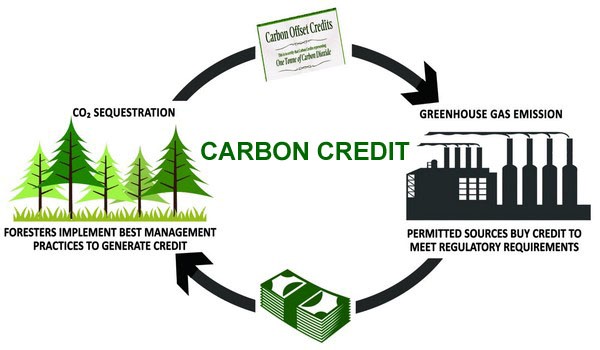

Clean Development Mechanism (CDM)

Key Features:

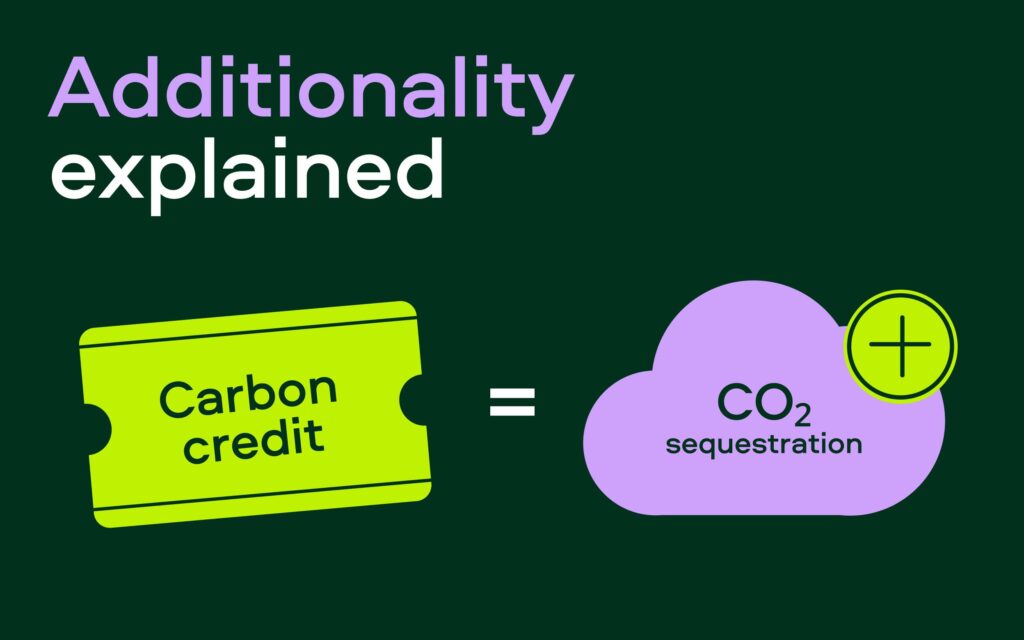

Additionality: Projects must demonstrate that the emission reductions are additional to what would have occurred in the absence of the project.

Sustainable Development: Projects should contribute to the sustainable development goals of the host country.

Process:

Validation: The PDD must be validated by an independent Designated Operational Entity (DOE).

Registration: Submit the validated PDD to the CDM Executive Board for registration.

Implementation and Monitoring: Implement the project and monitor emissions reductions according to the approved plan.

Verification: Emissions reductions must be verified by a DOE.

Issuance of CERs: Verified reductions are submitted to the CDM Executive Board, which issues CERs accordingly.

Compliance Guidelines:

- Transparency: Maintain transparent records of all project activities, emissions reductions, and monitoring data.

- Reporting: Submit regular monitoring reports for verification by a DOE.

- Sustainable Development: Ensure projects align with the host country’s sustainable development goals.

- Stakeholder Consultation: Engage stakeholders, including local communities, in the project planning and implementation process.

Joint Implementation (JI)

Key Features:

- Project Types: Similar to CDM, JI projects can include renewable energy, energy efficiency, reforestation, and methane capture.

- Track 1 and Track 2: JI has two tracks:

- Track 1: Countries with sufficient national inventory systems and compliance capabilities can approve and verify JI projects domestically.

- Track 2: Projects in countries without sufficient systems are overseen by the JI Supervisory Committee (JISC).

Process:

Host Country Approval: Obtain approval from the host country’s designated national authority.

Validation (Track 2): The PDD must be validated by an independent Accredited Independent Entity (AIE) for Track 2 projects.

Registration (Track 2): Submit the validated PDD to the JISC for registration.

Implementation and Monitoring: Implement the project and monitor emissions reductions according to the approved plan.

Verification: Emissions reductions must be verified by an AIE (Track 2) or through the host country’s processes (Track 1).

Issuance of ERUs: Verified reductions are submitted to the host country’s registry, which converts AAUs into ERUs.

Compliance Guidelines:

Transparency

Reporting

National Approval

Additionality

Track-Specific Compliance:

Compliance Guidelines for Kyoto Protocol Mechanisms

1. Project Design and Approval

Additionality: Clearly demonstrate that the project provides emission reductions beyond what would have occurred under a business-as-usual scenario.

2. Monitoring and Reporting

-

- Monitoring Plan: Develop and implement a detailed monitoring plan that aligns with approved methodologies.

- Data Collection: Collect and record data accurately and consistently.

- Periodic Reporting: Submit monitoring reports at regular intervals to the relevant authorities for verification.

3. Third-Party Verification

Verification Reports: Ensure that verification reports are comprehensive and transparent, detailing the methods and findings of the verification process.

4. Issuance of Credits

Credit Utilization: Use issued credits to meet national or corporate emission reduction targets.

5. Sustainable Development

Local Engagement: Engage local communities and stakeholders in project development and implementation.

6. Compliance and Penalties

Dispute Resolution: Utilize established dispute resolution mechanisms in cases of compliance issues.